The FDA’s Latest Vape List: Industry Reactions and Regulatory Challenges

The recent release of a downloadable, single-page vape list by the FDA has made waves throughout the vaping industry. According to this document, as of August 2023, “23 tobacco-flavored vapes and devices have been approved,” setting the official boundaries for what retailers can legally sell. However, closer examination of the list exposes inconsistencies in regulatory language and reveals a disconnect from the actual vape market. In reality, only six core devices have truly received authorization, with problems such as confusing product categories and inconsistent standards. These issues highlight deeper flaws in the FDA’s regulatory approach to vaping.

Table of Contents

I. The Regulatory Ambiguities Behind the List

(1) The Semantics of FDA’s Statistics

While the FDA claims 23 “vapes and devices” are authorized, only about 26% are distinct devices; the majority are cartridges or refills. For example, products like Vuse Vibe and Vuse Ciro offer nearly identical experiences but are listed as separate entries. Curiously, the list also includes Logic Vapeleaf—a heat-not-burn (HTP) product that uses solid tobacco capsules—despite its fundamental differences from standard e-liquid vapes. This approach exposes inconsistent definitions and confusing product classifications.

(2) The Debate Over HTP Categorization

Another issue is the FDA’s classification of Logic Vapeleaf as a “vape,” while Philip Morris International’s IQOS—a similar HTP product—is regulated separately. IQOS has received eight PMTA authorizations (including menthol refills) since 2019, yet neither the device nor its refills appear on the vape list. This raises questions: why exclude IQOS from the vape category? Is the FDA hesitant to approve low-risk menthol products because of a potential menthol ban? These gaps reveal unresolved tensions in regulatory logic.

II. The Reality of Authorized Products in the Marketplace

(1) The “True” Approved List

When heat-not-burn products and repeated authorizations are filtered out, the actual number of FDA-approved vapes drops to just six (or seven, counting different nicotine strengths of NJOY Daily):

-

Logic: Logic Pro (2 tobacco-flavored cartridges), Logic Power (1 tobacco refill)

-

NJOY: NJOY Daily (2 nicotine levels, both tobacco), NJOY Ace (3 tobacco refills)

-

Vuse: Vuse Solo (2 tobacco refills), Vuse Vibe (1 tobacco refill)

These products all use artificial tobacco flavors and are produced by major tobacco corporations, indicating a regulatory preference for established players.

(2) The Paradox of the Market

Since Brian King took charge of the FDA’s Center for Tobacco Products in 2022, no new e-liquid vapes have been approved—though IQOS refills have continued to receive authorization. Meanwhile, products like Vuse Ciro have been discontinued, making their FDA approvals irrelevant in practice. This situation—where products are authorized but unavailable—raises serious doubts about the usefulness of the FDA’s published list.

III. Unapproved Products: Realities and Risks

(1) Consumer Needs Overlooked by Regulation

A vast unauthorized market exists beyond the FDA’s list:

-

Product scope: Bottled e-liquids, refillable devices, fruit/menthol flavors, and disposables are all unapproved.

-

Distribution: Vape shops, convenience stores, and even top global brands like JUUL and SMOK aren’t included.

-

Brand profile: Over 60% of market players are independent brands, not affiliated with tobacco giants.

Despite the FDA having issued Marketing Denial Orders (MDOs) to over 320 companies, hundreds of applications remain pending, leaving the market in a regulatory gray zone.

(2) Legal Risks vs. Enforcement Reality

Although the FDA’s stance is “unauthorized = illegal,” enforcement is another story. Courts such as the Fifth Circuit have blocked some FDA actions, like the Marketing Denial Order for Vuse menthol refills. Thousands of products with ambiguous status are still widely available, leading to confusion for retailers. The FDA’s generally passive enforcement approach further dilutes regulatory clarity and effectiveness.

IV. Deeper Contradictions: Regulation vs. Market Demand

The FDA’s vape list exposes three fundamental problems:

-

Unclear technical definitions: The blurring of lines between vapes and HTP products leads to classification confusion.

-

Policy contradictions: Inconsistent positions regarding the menthol ban and low-risk products undermine the FDA’s credibility.

-

Overlooked consumer needs: Adult smokers seeking harm-reduction alternatives are left with few choices, as the authorized products fail to meet demand for diversity.

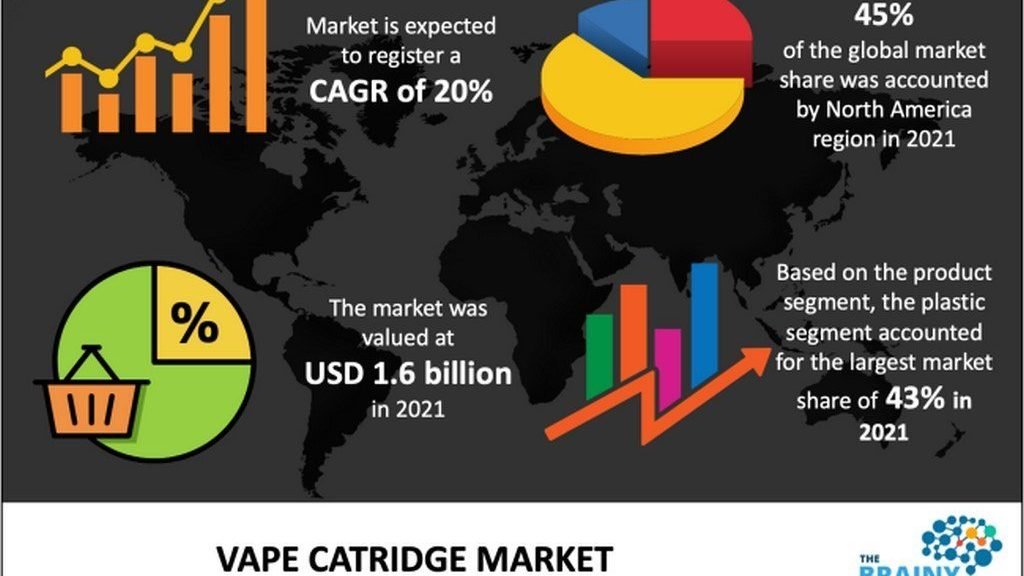

Experts stress that effective regulation should be grounded in scientific evidence—not political agendas. While the global vape market continues to expand by over 20% annually, the FDA’s listing process seems more symbolic than practical, falling short of meaningful public health goals. For consumers, the most prudent approach is to recognize the limitations of the FDA’s list and choose products that have passed independent third-party testing to minimize risk.